Delivering 6700% growth in microinsurance

Interview with Geric Laude, Pioneer Microinsurance

By Bert Opdebeeck

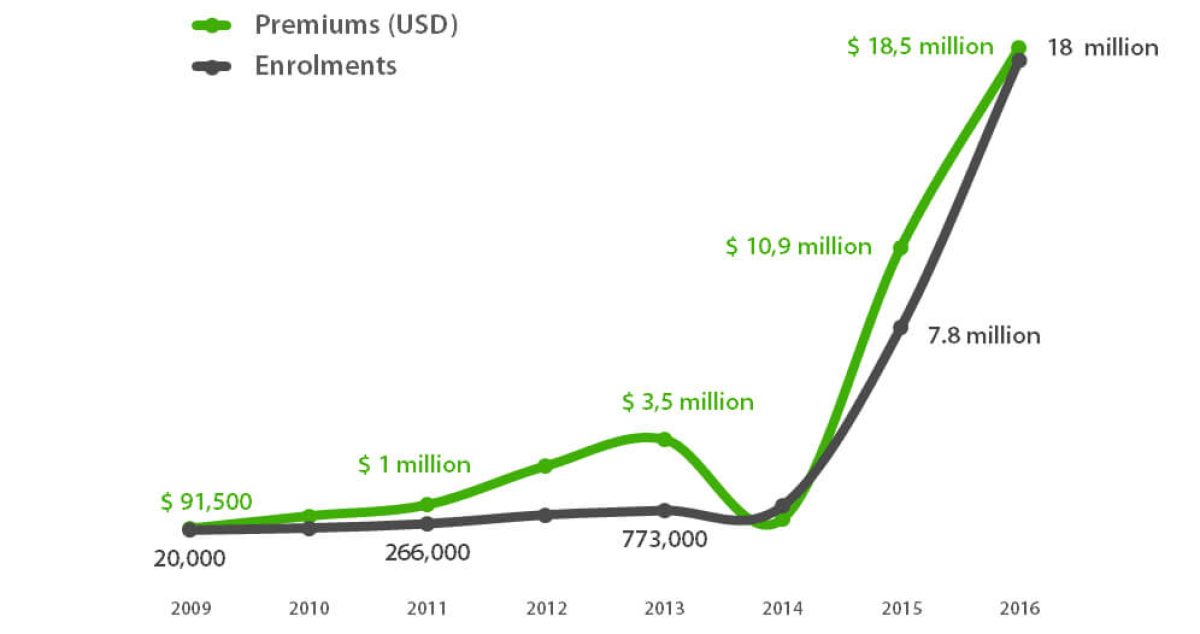

One of the most successful exponents of growing a microinsurance business is Pioneer Microinsurance in the Philippines. The company has grown enrolments from just over a quarter of a million to 18 million in the past five years. That’s a dazzling 6697 percent growth in half a decade!

This is particularly impressive because about half of these enrolments are for voluntary products in life, accident and property rather than mandatory products.

This success and how it was planned and delivered is the main reason why we’re so delighted to have our immersion training at Pioneer Microinsurance with the upcoming Microinsurance Master programme.

I recently sat down with Geric Laude, President and CEO of Card Pioneer. It was an excellent opportunity to ask some key questions about the secrets of Pioneer’s incredibly rapid growth.

His answers are packed with golden nuggets that deserve several blog posts! For now, I’ve condensed them down into four key points, as detailed below…

1. Plan for success

Success rarely happens by accident. Geric believes that microinsurance businesses must get the right people in the right positions; and then plan for growth.

Pioneer planned for their success and Geric puts the phenomenal growth down to the following key components:

- Assign a ‘champion’ to the role

Many microinsurance businesses appoint a coordinator in charge of rolling microinsurance products out to the market. Planning for success requires more than this. At Pioneer, the microinsurance side of the business was given a high degree of autonomy. A ‘champion’ (Geric) was appointed to a separate business segment with a wide mandate. He did not need to wait for approval on decisions from elsewhere but he frequently needed to engage with the larger parent insurance organisation to drive through strategies. In fact, he had to put all his energy and credentials into the process, risking his career. It was bold – but it paid off. - Go beyond the comfort zone

Insurance organisations often have a very traditional way of operating, with well-defined systems and processes that are not well-suited to the needs of microinsurance. Geric and key stakeholders within Pioneer had to challenge the existing mindset in order to bring more focus on the unique challenges of the poor Filipinos they serve.. - Be clear on the value proposition

Any microinsurance company must be clear on the value it offers the market – what it does better than any other company. Customers told Pioneer that they needed claims to be paid quickly and that is just what happened. Pioneer Microinsurance built a solid reputation as the insurer that pays claims fast: half of them within two days.

2. How to spur growth

Growth is first planned for – and then must be delivered. For Pioneer Microinsurance, this came down to several key focuses:

- Building reputation through a unique value proposition

Pioneer Microinsurance customers essentially became its champions, spreading the word and inspiring organic customer growth. - Reducing customer ‘churn’

Customers talking positively about you are less likely to change provider, allowing Pioneer Microinsurance to significantly grow its base. - Building strong partnerships

Customer growth is only part of the story; when word started spreading, prospective partners presented themselves to Pioneer Microinsurance. This presented new opportunities to spur growth for the business. - Incentivisation

During discussions with partners, new ways to incentivise staff to sell insurance, such as including it in employees’ performance reviews, presented themselves. This helped spur more volume for Pioneer Microinsurance.

3. Managing such rapid growth

Rapid growth presents great opportunities but also considerable challenges for companies, who must manage resources carefully. I asked Geric how Pioneer Microinsurance kept up with this growth and, in particular, their fast claims settlement.

Geric pointed out that Pioneer Microinsurance was able to leverage opportunities by:

- Separating and understanding the numbers

The microinsurance part of the business must be a separate entity with a separate set of figures apart from the general insurance side of the business. Geric and his team were better able to track progress and monitor what was working and what was not. By drilling down into these numbers, they quickly got to know exactly what was happening in the business. - Understanding and anticipating the rhythm of the business

By understanding the numbers, the Pioneer Microinsurance team has been better able to ‘tune in’ to the ‘rhythm’ of the business. This allows them to forecast 12 months and even 2-3 years ahead in terms of enrolments and claims. This has been incredibly important for managing growth effectively by planning for the right manpower and other resources. Geric argues that you can’t succeed by being reactive: if you don’t know what the numbers will be in 12 months’ time, planning becomes impossible and you will fail to live up to the expectations of your customers.

4. The road ahead: focus on customer centricity

Having experienced such astounding growth, I wondered how Geric saw the business developing from here.

He explained to me that the focus for Pioneer Microinsurance for the next five or ten years (and beyond) is evolving with the existing customer base and catering insurance solutions for their individual journeys.

For many people, Pioneer Microinsurance offers insurance for the very first time. Most of their customers are from poor backgrounds. However, over time, they will hopefully be able to work their way out of poverty – helped, in part, by increased microinsurance coverage.

Recognising the journey that poor Filipinos are on is key to the future success of Pioneer Microinsurance.

The focus, then, has switched from securing a high volume of new enrolments to better understanding and servicing the exact needs of existing customers – especially as these needs constantly evolve.

Recognising and developing the insurance solutions that will help them on their journeys – even before the people themselves know they need them – has become key for the future.

To achieve success in the future, Geric argues, requires organisations to be purposefully designed for customer centricity, rather than it simply being a reactive after-thought.

He believes that Pioneer Microinsurance will further evolve into a learning organisation, helping it to continue to provide exceptional service for its customers and contributing to the future growth of the business.

If you want to learn first-hand from Pioneer Microinsurance’s success, join the upcoming Microinsurance Master accelerator programme.

Starting on 3 July 2023, you will join a two-week immersion in Kenya and work closely with leaders from Pioneer Insurance. This is followed by 3 months of mentoring by microinsurance leaders to implement your takeaways back home. Express your interest here.