Microinsurance's Value Proposition: What's In It For You?

Microinsurance is often presented as a classic win-win-win.

Low-income people get protection; insurers get new clients; and intermediaries such as microfinance institutions get commission income.

But the obvious benefits might not be as obvious as they sound, while other important benefits are undervalued or forgotten.

The value proposition for low-income people

For many low-income people, their first microinsurance policy will be their first experience with any insurance.

This experience will shape their perceptions of insurance in general, so we all need to work hard to make the first impression a good one. To make sure people renew and increase their insurance coverage and reverse the rather poor reputation of insurance globally.

Lorenzo Chan Jr., CEO of Pioneer Group in the Philippines and host of the Microinsurance Master programme, expresses well what the essential qualities of insurance should be:

“Honesty, trust and reliability: you seek the same things in insurance as in friends.”

Unlike regular insurance, microinsurance seldom compensates for the complete loss that people suffer. If it did, the premium would not be affordable to most low-income communities.

Because microinsurance does not compensate for complete loss, it is only a partial solution. Its value increases in combination with other services or products; for instance, as a complement to social protection schemes, combined with a child savings or bundled with fertilisers.

More than with regular insurance, the speed of claims settlement is a key value proposition. Numerous studies have shown that the value of microinsurance seriously decreases when claims handling takes too long.

People with scarce financial resources can simply not wait for weeks or months for a refund. This challenges insurers to completely rethink and rebuild the way they handle claims.

All this calls for a good understanding of customer risks and needs, with considerable testing and tweaking to find the best insurance solutions. My previous article on customer discovery explores this further.

The value proposition for insurance companies

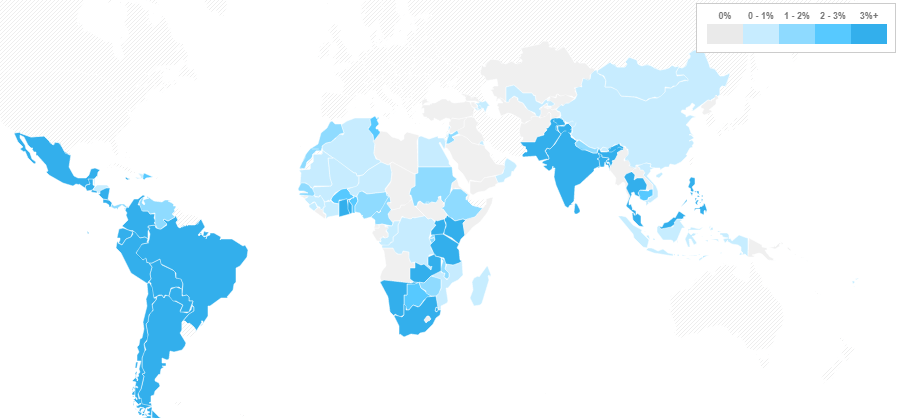

Insurers in emerging economies are mostly only dealing with companies and individuals in the small ‘formal’ economy. Microinsurance has the potential to unlock the huge, untapped ‘informal’ market and become an important business line for revenue.

However, anyone entering microinsurance solely for short-term financial gain will be on a disappointing trip (see my article – What’s The ‘Why’ Of Microinsurance Master?).

Trimmed-down versions of the most popular and profitable insurance products that do not respond specifically to the needs of low-income people are doomed to fail.

A longer term approach is to become the insurance partner of emerging customers; growing together requires significant upfront investment and a strategy that, if carried out effectively, will lead to mutual benefits for years and hopefully decades thereafter.

An interesting ‘side effect’ of microinsurance is that it requires us to completely rethink insurance practises and procedures.

Successful insurers, such as Pioneer Group in the Philippines, benefit from field-testing their ideas in the microinsurance market. This eventually strengthens their retail and corporate insurance practises too.

Even well-established international insurance conglomerates can learn from microinsurance.

The value proposition for MFIs and other microinsurance intermediaries

Microinsurance can make a product or service that it’s bundled with more attractive.

Bags of fertiliser with insurance potentially have a major competitive edge over those without. The same applies to mobile phone top-up packages. Both example can increase customer loyalty.

For microfinance institutions too, microinsurance can provide an attractive income stream. However, profit as the sole motivation is a poor foundation. As already alluded to, insurance for low-income people requires understanding of the customer needs and a considerable investment in time and effort to explain – all for a small commission. It cannot compete with profits generated from commission on loans, for instance.

From a customer-centric viewpoint, however, microinsurance is the ‘missing piece’ for many financial solutions.

Insurance ‘completes’ saving and credit products, increasing the value of both, increasing saving loyalty, and allowing MFIs to grant credits to excluded people and groups that it could otherwise not reach. While the direct financial benefit might be limited, the promise of indirect benefit, through better savings and credit returns, are important. This logic calls for an holistic approach to insurance, whereby insurance solutions are complementary and tailored to the credit and savings offering of an MFI. MFIs with a good understanding of their customer needs and an extensive outreach can work with insurance companies to create tailored products that fit client needs.

This is where the circle is completed and a true win-win-win exists.

Bringing the value propositions together

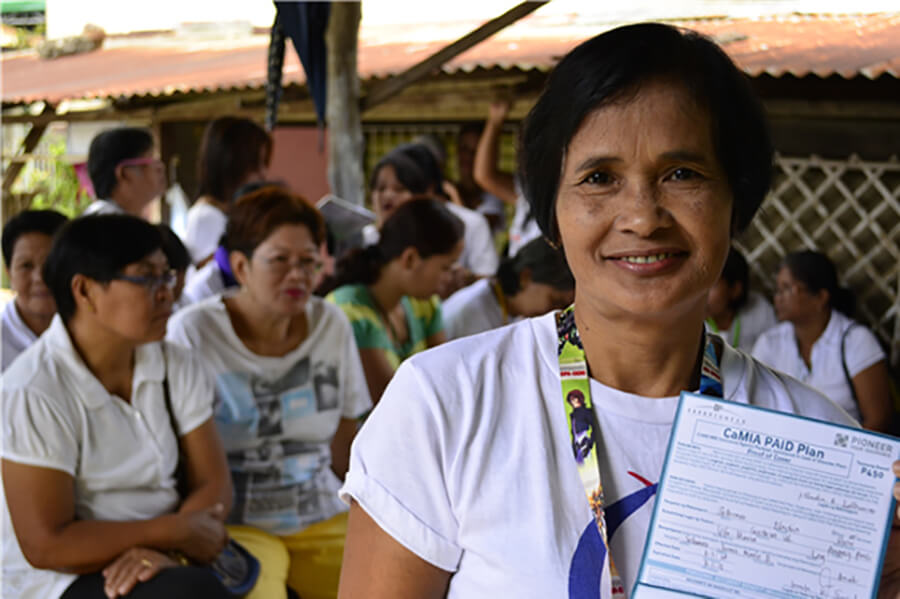

The partnership between Card MRI, the largest member-based MFI in the Philippines, and Pioneer Insurance, proves that this win-win-win is possible.

These organisations formed CardPioneer, a microinsurance joint venture that combines the strength and member proximity of Card MRI with the insurance knowhow of Pioneer Insurance. It has resulted in effective customer-centric microinsurance solutions for low-income people.

Pioneer Microinsurance has grown from 0.26m to 18m enrolments in just five years. This has been achieved largely by maintaining a strong customer-centric focus and fast claims settlements, half of them within two days.

In February 2019, the Microinsurance Master programme will camp out for two weeks at Pioneer Microinsurance. If you want to learn their ‘secret sauce’ to make your own microinsurance practice thrive, apply now.